Selling Your Las Vegas Home After the Death of a Spouse

Related Articles

- Selling Your Las Vegas Home to Downsize in Retirement

- Selling a Las Vegas Home with Multiple Owners

- Perfect Downsizing Layouts in Las Vegas

Losing a spouse is one of life's most difficult experiences. When you are ready to sell the home you shared, the process involves both emotional and practical challenges. There is no timeline for when you should be ready. Some widows and widowers sell quickly because staying is too painful. Others wait years before feeling prepared. Both approaches are valid.

Legal Considerations First

Before listing, several legal matters need attention:

Title and ownership. How you held title affects what happens next. In Nevada, common arrangements include:

| Title Type | What Happens |

|---|---|

| Joint tenancy with right of survivorship | Property passes automatically to surviving spouse |

| Community property with right of survivorship | Property passes automatically to surviving spouse |

| Community property (without survivorship) | Deceased spouse's share passes through probate or trust |

| Property in trust | Follows trust terms, usually passes to surviving spouse |

Probate requirements. If probate is required, you may need court approval to sell. This adds time and complexity to the process.

Death certificate. You will need certified copies for title transfer and closing.

Tax Implications

Selling after a spouse's death has important tax considerations, similar to concerns about selling before two years but with different rules:

Stepped-up basis. When a spouse passes, the property's tax basis typically steps up to fair market value at death. This can significantly reduce or eliminate capital gains tax.

Capital gains exclusion. If you sell within two years of your spouse's death, you may still qualify for the $500,000 married exclusion rather than the $250,000 single exclusion.

Consult a tax professional. These rules are complex and your specific situation matters. Get professional advice before selling.

Emotional Readiness

There is no right time to sell. Consider:

Give yourself permission to wait. Unless financial pressure requires immediate action, take the time you need.

Recognize practical triggers. A home that is too large, too expensive, or too difficult to maintain may accelerate the decision. Many surviving spouses find that downsizing in retirement becomes more appealing after losing a partner.

Separate the house from memories. Your memories live in you, not the walls. Moving does not mean forgetting.

Involve trusted people. Family, friends, or a counselor can provide perspective and support.

Practical Preparation

When you are ready to move forward:

Sort belongings gradually. Do not try to clear decades of possessions in a weekend. Take it room by room, category by category.

Accept help. Family members or professional organizers can assist with sorting and decisions.

Keep what matters. You do not have to let go of everything. Keep items with genuine meaning.

Prepare the home. Once personal items are sorted, professional photography and proper presentation become important.

Working with an Agent

Choose an agent who understands your situation:

Patience. You need someone who will not rush you through decisions.

Sensitivity. The process should be handled with appropriate care.

Experience. Familiarity with estate and survivor sales helps navigate unique issues.

Communication. Clear, compassionate communication throughout the process.

What to Expect During the Sale

The selling process itself follows normal steps, but may feel different:

Showings. Strangers walking through your home can feel intrusive. Remember that leaving during showings is recommended for all sellers.

Negotiations. You may have less emotional bandwidth for back-and-forth. A good agent handles buyer repair requests and negotiations on your behalf.

Closing. Understanding what happens at closing reduces stress on an already emotional day.

Deciding Where to Go Next

Your next home should fit your new life:

Size. Many surviving spouses find smaller homes more manageable and less lonely.

Location. Being near family, friends, or support systems may matter more now.

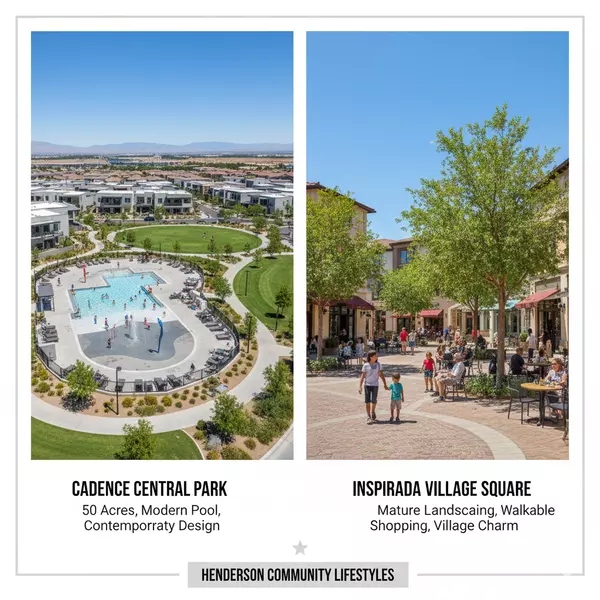

Community. Some find comfort in 55+ communities with built-in social opportunities.

Maintenance. Lower-maintenance properties reduce burden and worry.

Where to Start

If you are considering selling your Las Vegas home after losing a spouse, I understand this is a difficult time. I can provide guidance at whatever pace feels right for you, with no pressure to move faster than you are ready.

Ready to have a conversation? Request a free home evaluation here or reach out directly when you are ready to talk.

Frequently Asked Questions About Selling a Las Vegas Home After Losing a Spouse

Categories

- All Blogs (600)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (13)

- Cadence (10)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (54)

- Housing Market Trends (94)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (17)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (164)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION