Selling Your Las Vegas Home After Owning Less Than Two Years

Related Articles

- Las Vegas Condo Prices and Trends: Market Update

- Establishing Nevada Residency: Complete Guide

- Is Las Vegas Still Affordable in 2025?

Life changes sometimes require selling sooner than planned. A job opportunity, family situation, or change in circumstances may mean selling your Las Vegas home before the two-year mark. While this is entirely possible, there are financial considerations you should understand before proceeding.

The Two-Year Rule for Capital Gains

The IRS allows homeowners to exclude up to $250,000 in capital gains ($500,000 for married couples filing jointly) when selling their primary residence. However, this exclusion requires owning and living in the home for at least two of the five years before the sale.

If you sell before meeting this requirement, any profit may be subject to capital gains tax.

| Ownership Duration | Tax Treatment |

|---|---|

| Less than 1 year | Short-term capital gains (taxed as ordinary income) |

| 1-2 years | Long-term capital gains (lower rates, but no exclusion) |

| 2+ years as primary residence | Up to $250K/$500K excluded from taxes |

Partial Exclusion for Qualifying Circumstances

The IRS allows a partial exclusion if you sell before two years due to certain qualifying circumstances:

Job relocation. If your new job is at least 50 miles farther from your home than your old job was.

Health reasons. If you sell due to illness, injury, or a doctor's recommendation.

Unforeseen circumstances. Death, divorce, multiple births from a single pregnancy, job loss, or other IRS-specified events.

The partial exclusion is prorated based on how long you lived in the home. If you lived there 18 months (75% of two years), you may exclude 75% of the maximum exclusion.

The Financial Reality

Beyond taxes, selling quickly often means losing money:

Selling costs. Agent commissions, title fees, and closing costs typically run 8-10% of sale price. You need significant appreciation to break even after these costs.

Limited equity building. Early mortgage payments are mostly interest. After one year, you have built very little equity through payments.

Market risk. If prices have not risen (or have fallen) since you bought, you may sell for less than you paid.

Running the Numbers

Before deciding to sell, calculate your actual position:

Current value. What is your home worth today?

Original purchase price. What did you pay, including closing costs?

Current loan balance. How much do you still owe?

Selling costs. Estimate 8-10% of sale price.

Tax liability. If you have gains, what will you owe?

If sale price minus loan balance minus selling costs minus taxes equals a negative number, you will need to bring money to closing.

When Selling Early Makes Sense

Despite the costs, selling before two years sometimes makes sense:

Major life changes. Job relocation, divorce, or health issues may require moving regardless of financial impact.

Significant appreciation. If your home has appreciated substantially, you may still profit after costs and taxes.

Avoiding larger losses. If you expect the market to decline or cannot afford payments, selling at a small loss may be better than waiting.

Better opportunity elsewhere. Sometimes the cost of selling is worth it to pursue a better opportunity in another location.

Alternatives to Consider

Before committing to sell early:

Wait if possible. If you can wait until the two-year mark, you preserve the tax exclusion.

Rent it out. Convert to a rental property while you move elsewhere. This has its own tax and practical implications but avoids the immediate sale.

Rent it and sell later. You can rent the home temporarily and still claim the exclusion if you sell within three years of moving out (and meet the two-year ownership and use test within the five-year window).

Consult Professionals

Early sales have tax complexity. Before proceeding, consult a tax professional who can analyze your specific situation, calculate potential tax liability, and advise on strategies to minimize impact.

Where to Start

If you are considering selling your Las Vegas home before the two-year mark, understanding your financial position is essential. I can provide a market analysis to determine current value and help you evaluate whether selling makes sense.

Ready to explore your options? Request a free home evaluation here or reach out directly to discuss your situation.

Frequently Asked Questions About Selling Your Las Vegas Home Before Two Years

Categories

- All Blogs (600)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (13)

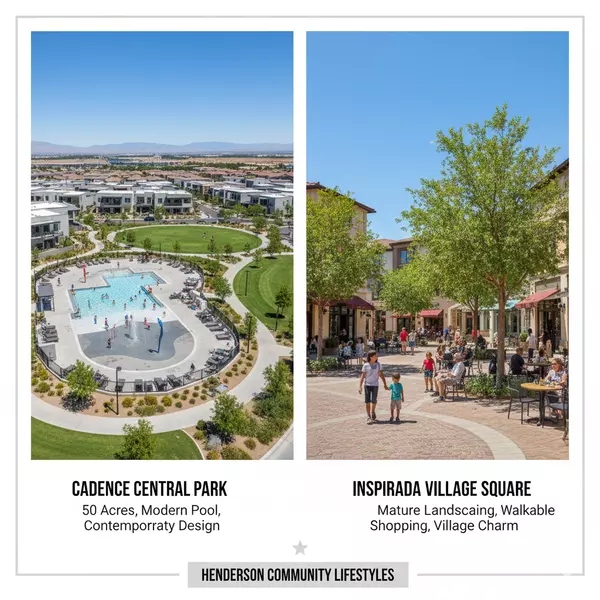

- Cadence (10)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (54)

- Housing Market Trends (94)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (17)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (164)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION