Nevada Probate Process: Timeline & Steps for Real Estate

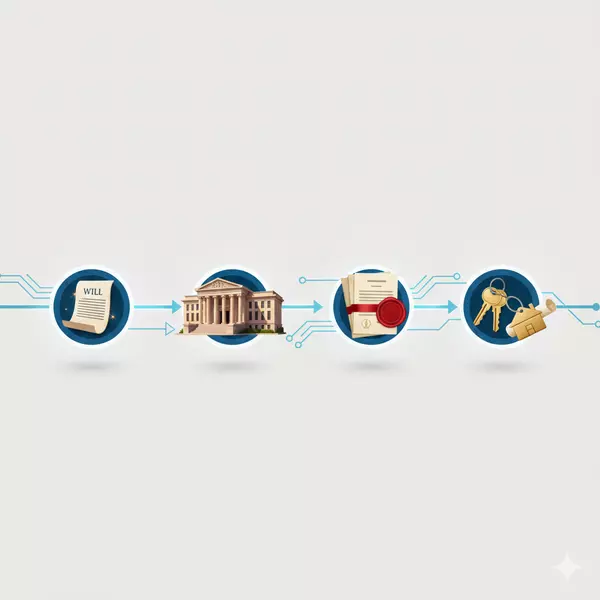

The Nevada probate process typically takes 6-12 months for straightforward estates, though complex situations can extend to 18+ months—and understanding this timeline is crucial for executors planning to sell inherited real estate in Las Vegas. This guide walks through the Nevada probate timeline step by step.

Nevada Probate Timeline Overview

Phase : Typical Timeline

Court hearing : 2-6 weeks after filing

Letters issued : At or shortly after hearing

Creditor period : 90 days (Nevada requirement)

Property can be sold : After Letters issued (with IAEA)

Final distribution : 6-12+ months total

Step-by-Step Process

Step 1: File Petition (Weeks 1-2)

Probate begins by filing a petition with Clark County District Court. The petition asks the court to admit the will (if one exists), appoint an executor/personal representative, and authorize administration of the estate. Filing fees run several hundred dollars.

Step 2: Notice & Hearing (Weeks 2-6)

Notice must be given to heirs and beneficiaries. A hearing is scheduled where the court reviews the petition, confirms the will's validity, and formally appoints the executor. Nevada courts are generally efficient, with hearings scheduled within a few weeks of filing.

Step 3: Letters Testamentary/Administration Issued

Once appointed, the executor receives "Letters Testamentary" (if there's a will) or "Letters of Administration" (if no will). These letters are your legal authority to act on behalf of the estate—including listing and selling real estate. You'll need certified copies for banks, title companies, and real estate transactions.

Step 4: Creditor Notice Period (90 Days)

Nevada requires publishing notice to creditors and waiting 90 days for claims. Known creditors must be notified directly. This period protects the estate from later claims. Real estate can often be listed and sold during this period, but final distribution waits until creditor period closes.

Step 5: Inventory & Appraisal

The executor must file an inventory of estate assets with the court, including real estate. For property you plan to sell, getting a professional appraisal or broker price opinion establishes fair market value and protects the executor from claims of selling too low.

Step 6: Sell Real Estate

With IAEA (Independent Administration of Estates Act) authority, the executor can sell real estate without court confirmation. Without IAEA, the sale may need court approval and could be subject to overbidding. A probate-experienced real estate agent handles either process.

Step 7: Final Accounting & Distribution

After debts are paid and property sold, the executor files a final accounting showing all income, expenses, and proposed distribution. Once approved, remaining assets are distributed to heirs and the estate is closed.

What Affects Timeline

- Will contests: Can add months or years if heirs dispute

- Complex assets: Multiple properties, businesses, investments take longer

- Creditor claims: Disputed claims extend timeline

- Tax issues: Estate tax returns or IRS matters delay closing

- Heir cooperation: Uncooperative heirs slow everything down

The Bottom Line

Nevada's probate process is relatively efficient compared to other states, but still takes 6-12 months minimum. Understanding the timeline helps executors plan for property maintenance costs, carrying expenses, and realistic sale timing. Working with a probate attorney and experienced real estate agent keeps the process moving efficiently.

I help executors navigate probate real estate sales in Las Vegas. If you need guidance on timing and process, reach out for a consultation.

Nevada Probate Process FAQs: Timeline & Real Estate Sales

Categories

- All Blogs (169)

- Anthem (1)

- Buyers (4)

- Downsizing (12)

- Expired Listings (1)

- Housing Market Trends (91)

- Informative (20)

- Luxury (1)

- MacDonald Highlands (1)

- Madeira Canyon (1)

- Mountains Edge (9)

- Probate (19)

- Queensridge (1)

- Relocation (2)

- Sellers (3)

- Summerlin (11)

- Sun City Summerlin (1)

- Thoughts on Home Tour (2)

Recent Posts

GET MORE INFORMATION