Inherited Property: Should You Keep, Sell, or Rent?

Inheriting property in Las Vegas presents a significant financial decision—selling provides immediate liquidity while keeping the property builds long-term wealth, but each option has tax implications, ongoing costs, and practical considerations that heirs must evaluate. This guide helps you analyze the keep vs. sell vs. rent decision.

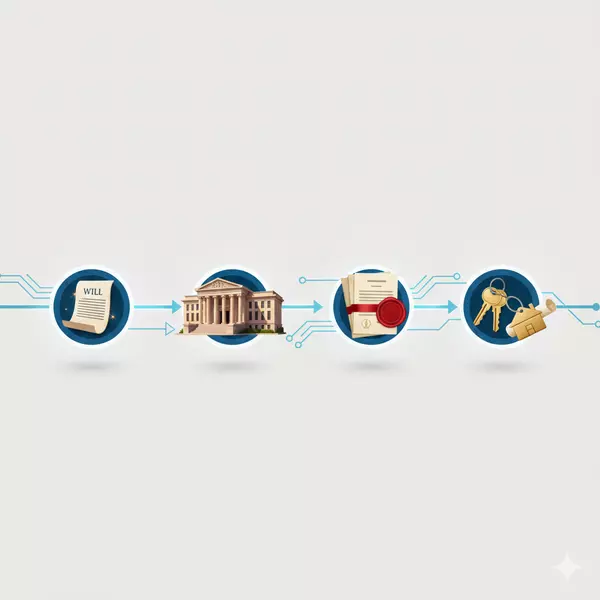

Option 1: Sell the Property

Advantages

- Immediate liquidity: Cash to distribute among heirs or invest elsewhere

- Stepped-up basis benefit: Minimal capital gains if sold soon after inheritance

- No ongoing responsibility: Eliminates maintenance, taxes, insurance costs

- Clean distribution: Cash is easier to divide among multiple heirs

- No landlord hassles: Avoid tenant issues if you don't want to manage property

Disadvantages

- Lose potential appreciation

- Transaction costs (commissions, closing costs)

- May sell in unfavorable market

- Emotional—selling family home can be difficult

Option 2: Keep as Primary/Second Home

Advantages

- Benefit from future appreciation

- Preserve family memories/legacy

- Use as vacation home if not local

- Heir may move in (no housing cost)

Disadvantages

- Ongoing costs: mortgage, taxes, insurance, maintenance

- Difficult if multiple heirs—who pays, who decides?

- Property may need significant updates

- Ties up inheritance in illiquid asset

Option 3: Rent the Property

Advantages

- Income stream: Las Vegas rental market is strong

- Keep appreciation: Property continues gaining value

- Tax benefits: Depreciation, expense deductions

- Defer decision: Can sell later when market or timing is better

Disadvantages

- Landlord responsibilities (or property management costs)

- Tenant risks: vacancies, damage, evictions

- Multiple heirs complicates management

- Lose stepped-up basis benefit over time (depreciation recapture)

- May need repairs/updates before renting

Key Questions to Ask

- How many heirs, and can they agree on strategy?

- Does any heir want to live in or use the property?

- What's the property condition—rent-ready or needs work?

- Is there a mortgage, and can estate/heirs afford payments?

- Do heirs need cash now, or can they wait?

- Who will manage if rented (local heir, property manager)?

The Bottom Line

There's no universal right answer. Selling is cleanest when multiple heirs need to split proceeds. Keeping makes sense when one heir will use it. Renting works when heirs can cooperate on management and want long-term investment. Consult with a CPA on tax implications and a probate attorney on distribution requirements before deciding.

I help heirs evaluate their options for inherited Las Vegas property. Whether you're leaning toward selling, renting, or keeping, reach out for market analysis and guidance.

Categories

- All Blogs (169)

- Anthem (1)

- Buyers (4)

- Downsizing (12)

- Expired Listings (1)

- Housing Market Trends (91)

- Informative (20)

- Luxury (1)

- MacDonald Highlands (1)

- Madeira Canyon (1)

- Mountains Edge (9)

- Probate (19)

- Queensridge (1)

- Relocation (2)

- Sellers (3)

- Summerlin (11)

- Sun City Summerlin (1)

- Thoughts on Home Tour (2)

Recent Posts

GET MORE INFORMATION