Selling Inherited Property with Multiple Heirs: Managing Disagreements

Inherited property with multiple heirs often creates conflict—one sibling wants to sell immediately while another wants to keep the family home, or heirs disagree on price, timing, or distribution—making executor navigation of these dynamics crucial to successful sales. This guide covers strategies for managing multiple-heir situations.

Common Sources of Conflict

- Sell vs. keep: Some heirs want cash now; others have emotional attachment

- Pricing disagreements: "Mom always said it was worth $600K"—but market says $450K

- Repair decisions: Fix up to get more, or sell as-is quickly?

- Personal property: Who gets what from the house?

- Buyout terms: One heir wants to buy out others—at what price?

- Carrying costs: Who pays mortgage, taxes, maintenance during probate?

Executor's Role

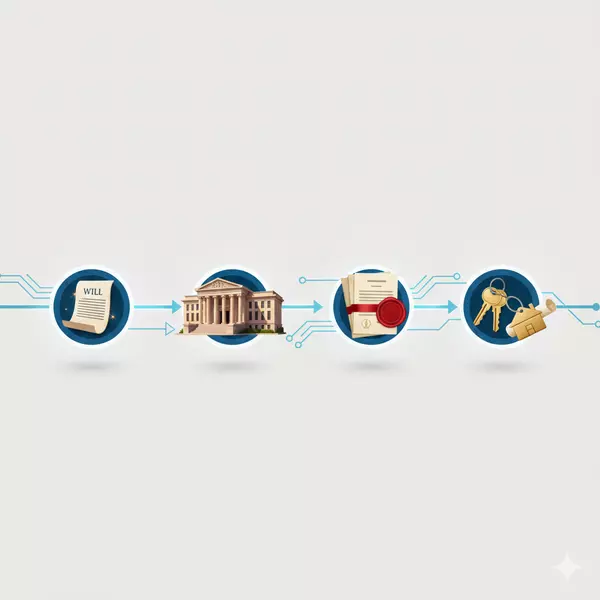

The executor has authority to make decisions about estate property. While keeping heirs informed is wise, the executor doesn't need unanimous agreement to sell. The executor's duty is to the estate, not to individual heirs' preferences. This authority exists precisely because consensus is often impossible.

Strategies for Managing Disagreements

1. Get Professional Valuations

Disputes about price often stem from unrealistic expectations. A professional appraisal or detailed CMA provides objective evidence of value. Hard to argue with comparable sales data.

2. Document Everything

Keep records of all decisions, communications, and rationale. If an heir later claims the executor mismanaged the sale, documentation provides protection. Email summaries after phone conversations.

3. Communicate Regularly

Keep all heirs informed even if they disagree. Surprises create more conflict. Send updates on showings, offers, and timeline. Transparency reduces suspicion.

4. Set Clear Deadlines

Give heirs reasonable time to remove personal items, make buyout offers, or express concerns—then proceed. Open-ended timelines let conflict fester and cost the estate money in carrying costs.

5. Consider Buyout Options

If one heir wants to keep the property, they can buy out others' shares at fair market value. Get an appraisal, calculate shares, and give reasonable time to secure financing. This preserves the property for the heir who wants it while providing cash to others.

When to Involve Professionals

- Probate attorney: Legal guidance on executor authority and heir rights

- Mediator: Neutral third party for severe family conflict

- Probate real estate agent: Experienced in navigating multiple-heir dynamics

- Court: Partition action to force sale if heirs are completely deadlocked

The Bottom Line

Multiple heirs make probate real estate more complex, but not impossible. The executor has authority to act in the estate's interest. Professional valuations provide objectivity. Clear communication and documentation protect everyone. When conflicts are severe, don't hesitate to involve professionals who specialize in these situations.

I've helped many families navigate multiple-heir property sales. If you're dealing with disagreements among heirs, reach out for guidance on moving forward productively.

Frequently Asked Questions About Stepped-Up Basis and Inherited Property Taxes

Categories

- All Blogs (169)

- Anthem (1)

- Buyers (4)

- Downsizing (12)

- Expired Listings (1)

- Housing Market Trends (91)

- Informative (20)

- Luxury (1)

- MacDonald Highlands (1)

- Madeira Canyon (1)

- Mountains Edge (9)

- Probate (19)

- Queensridge (1)

- Relocation (2)

- Sellers (3)

- Summerlin (11)

- Sun City Summerlin (1)

- Thoughts on Home Tour (2)

Recent Posts

GET MORE INFORMATION