How to Value a Probate Property in Las Vegas

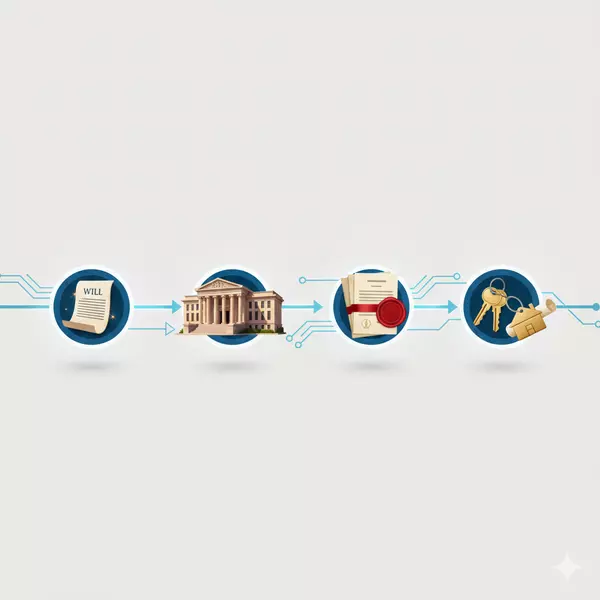

Accurately valuing probate property protects the executor from claims of selling too low while ensuring fair distribution to heirs—and in Las Vegas's dynamic market, this requires current professional analysis rather than assumptions based on past values or Zillow estimates. This guide covers valuation methods for probate real estate.

Why Accurate Valuation Matters

- Fiduciary protection: Documents you sought fair market value

- Heir fairness: Ensures beneficiaries receive appropriate value

- Court requirements: Inventory filings require property values

- Tax basis: Date-of-death value establishes stepped-up basis for heirs

- Pricing strategy: Proper listing price leads to faster sale

Valuation Methods

Formal Appraisal ($400-$600)

Licensed appraiser provides detailed written report meeting professional standards. Most defensible valuation method. Recommended for estates with potential disputes, high-value properties, or when court requires formal appraisal. Takes 1-2 weeks to complete.

Broker Price Opinion (BPO) ($0-$150)

Experienced real estate agent provides market analysis based on comparable sales. Less formal than appraisal but often sufficient for probate. Many probate agents provide BPOs as part of their listing services. Completed in days rather than weeks.

Comparative Market Analysis (CMA)

Standard tool agents use to recommend listing price. Analyzes recent sales, active listings, and market conditions. Similar to BPO but focused on determining optimal sale price rather than point-in-time value.

Challenges with Probate Properties

Deferred Maintenance

Many inherited properties have years of neglected maintenance—especially if the deceased was elderly or ill. Valuations must account for condition issues: outdated systems, worn flooring, needed repairs. "As-is" value may be significantly less than updated comparable properties.

Personal Property

Homes full of belongings affect showing appeal and buyer perception. Valuation should consider current cluttered condition vs. potential value if cleared and cleaned. Most probate sales occur with property as-is.

Market Timing

Date-of-death value matters for tax purposes. Sale price months later may differ due to market changes. Work with professionals who understand the distinction between date-of-death valuation and current market pricing.

What to Avoid

- Zillow/online estimates: Don't account for condition, not accepted by courts

- Tax assessed value: Often significantly differs from market value

- Family assumptions: "Mom always said it was worth..." isn't evidence

- Old appraisals: Values change—need current analysis

The Bottom Line

Get professional valuation before listing probate property. For most estates, a detailed BPO or CMA from an experienced probate agent is sufficient. For contested estates or high-value properties, invest in a formal appraisal. Proper valuation protects the executor and ensures fair treatment of beneficiaries.

I provide detailed property valuations for probate estates in Las Vegas. If you need to establish fair market value for inherited property, reach out for a professional assessment.

Probate Property Valuation FAQ: Las Vegas Estate Appraisal Questions

Categories

- All Blogs (169)

- Anthem (1)

- Buyers (4)

- Downsizing (12)

- Expired Listings (1)

- Housing Market Trends (91)

- Informative (20)

- Luxury (1)

- MacDonald Highlands (1)

- Madeira Canyon (1)

- Mountains Edge (9)

- Probate (19)

- Queensridge (1)

- Relocation (2)

- Sellers (3)

- Summerlin (11)

- Sun City Summerlin (1)

- Thoughts on Home Tour (2)

Recent Posts

GET MORE INFORMATION