Inherited Property with Liens: How to Clear Title for Sale

Liens against inherited property—whether from unpaid taxes, judgments, or contractor bills—must be resolved before the property can be sold with clear title, often requiring negotiation with creditors or payment from estate funds. This guide covers handling liens on probate property in Las Vegas.

Common Types of Liens

Property Tax Liens

Unpaid property taxes result in automatic liens. Clark County tax liens accrue penalties and interest. If severely delinquent, the county can eventually sell the property at tax auction. These liens must be paid at closing from sale proceeds.

HOA Liens

Unpaid HOA dues create liens. Nevada HOA liens have super-priority status for up to 9 months of assessments—they can even take priority over first mortgages. HOA liens must be satisfied at closing. Get a current statement and payoff from the HOA.

Judgment Liens

If the deceased lost a lawsuit, the judgment creditor may have recorded a lien against the property. Judgment liens must be paid or negotiated before clear title can pass. Sometimes creditors accept less than full amount to settle.

Mechanic's Liens

Contractors who weren't paid for work can file mechanic's liens. These must be resolved—either by paying, negotiating settlement, or disputing validity through legal process.

IRS/State Tax Liens

Unpaid income taxes can result in federal or state tax liens. These are serious—the IRS has significant collection powers. Work with a tax professional to understand options and negotiate if needed.

Discovering Liens

- Title search: Title company runs preliminary report showing recorded liens

- HOA status letter: Shows current balance and any amounts owed

- Tax records: County treasurer shows property tax status

- Court records: Judgment searches reveal court-ordered liens

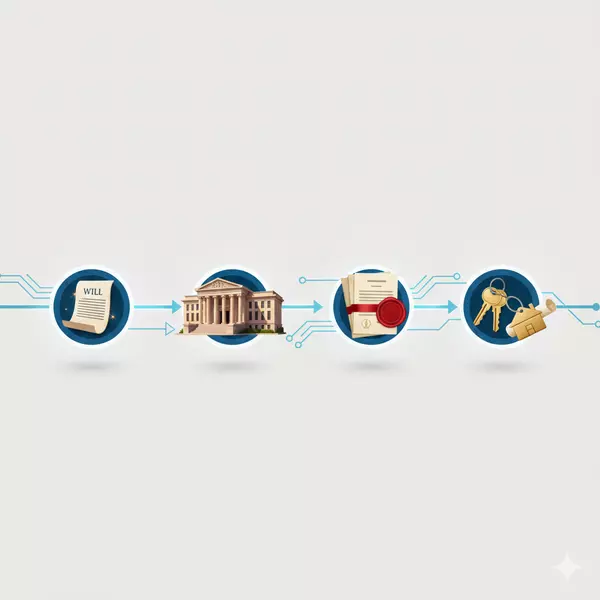

Resolving Liens

Pay in Full

Simplest solution—pay the lien from estate funds or from sale proceeds at closing. Title company handles payoff and obtains lien release. Works for legitimate liens the estate acknowledges.

Negotiate Settlement

Creditors often accept less than full amount, especially for old judgment liens or if the estate has limited assets. Negotiation can reduce lien amounts significantly. Get any agreement in writing with clear release terms.

Dispute Validity

Some liens may be invalid—wrong property, expired, procedurally defective. Work with the probate attorney to challenge invalid liens. May require court action to clear title.

Escrow Holdback

Sometimes title company will close with funds held in escrow to resolve a lien that's being disputed or negotiated. Allows sale to proceed while lien resolution continues.

If Liens Exceed Property Value

When total liens exceed property value, the estate may be insolvent for real estate purposes. Options include negotiating with creditors for reduced payoffs, allowing foreclosure by senior lienholder, or working with attorney on priority of claims. Heirs generally aren't personally liable for deceased's debts beyond estate assets.

The Bottom Line

Liens complicate but don't prevent probate sales. Discover them early through title search, understand amounts owed, and resolve through payment, negotiation, or dispute. A probate-experienced agent and attorney help navigate lien issues efficiently.

I help executors work through properties with lien issues in Las Vegas. If you've discovered liens on inherited property, reach out to discuss resolution strategies.

Frequently Asked Questions About Clearing Liens on Inherited Property in Las Vegas

Categories

- All Blogs (169)

- Anthem (1)

- Buyers (4)

- Downsizing (12)

- Expired Listings (1)

- Housing Market Trends (91)

- Informative (20)

- Luxury (1)

- MacDonald Highlands (1)

- Madeira Canyon (1)

- Mountains Edge (9)

- Probate (19)

- Queensridge (1)

- Relocation (2)

- Sellers (3)

- Summerlin (11)

- Sun City Summerlin (1)

- Thoughts on Home Tour (2)

Recent Posts

GET MORE INFORMATION