Anthem Henderson Real Estate Forecast 2026-2027: What to Expect

Related Articles

What's next for Anthem real estate? Will prices keep dropping, stabilize, or recover?

Here's the realistic 2026-2027 forecast for Anthem Henderson.

Where We Are Now (Late 2025)

Anthem median prices: $665K to $750K depending on section. Down 12% year-over-year in some sections, stable in others. Days on market: 50 to 68 days average. Inventory: up compared to 2023-2024 but still below pre-COVID levels.

The market corrected from 2021-2022 peak pricing. Anthem isn't crashing, but the frenzy is over.

2026 Price Forecast

Most likely scenario (60% probability): Modest appreciation of 2% to 4% annually. Anthem median moves from $665K to $678K to $695K. Stable, predictable, boring growth. Not sexy but sustainable.

Optimistic scenario (25% probability): Stronger appreciation of 5% to 7% if mortgage rates drop below 6% and buyer demand surges. Anthem could push toward $700K to $750K median by end of 2026. Requires rate cuts and economic confidence.

Pessimistic scenario (15% probability): Flat to slight decline of 0% to 2% if recession hits or rates spike above 7.5%. Anthem stalls at $650K to $665K median through 2026. Possible if economic conditions deteriorate.

Most realistic outcome: 2% to 4% annual appreciation through 2027. Anthem recovers slowly from 2025 correction but doesn't return to 2021-2022 peak pricing.

Inventory Trends

Inventory will gradually increase through 2026 as more sellers accept the "new normal" pricing. The lock-in effect (homeowners stuck with 3% mortgages) is weakening.

2026 inventory prediction: 10% to 20% more listings than 2025. Still below pre-COVID levels but enough to give buyers real choices. Days on market extends to 60 to 75 days average.

2027 inventory prediction: Continues trending up as more homeowners realize they need to move regardless of rate environment. Inventory stabilizes at healthier levels.

More inventory means more negotiation power for buyers. Sellers will need realistic pricing and good condition to compete.

Buyer Demand

Retiree demand (Sun City Anthem): Remains strong. Baby Boomers continue retiring and downsizing. Cash buyers less sensitive to mortgage rates. Sun City Anthem holds value better than other Anthem sections due to consistent 55+ demand.

Family demand (Anthem Highlands, Coventry): Rate-dependent. If rates drop to 5.5% to 6%, families return aggressively. If rates stay above 6.5%, demand remains moderate. School quality (Liberty, Coronado) keeps Anthem competitive for families.

Luxury demand (Country Club, Madeira): Slower. High-net-worth buyers are pickier in balanced markets. Expect 90 to 120+ days on market for $1.5M+ properties through 2026-2027.

Investor demand: Low. Anthem doesn't cash flow at current prices. Investors focus on cheaper Henderson neighborhoods with better rental yields.

Mortgage Rate Impact

Current rates: 6.3% to 6.8% for 30-year fixed. Most forecasts predict rates stabilize around 6% to 6.5% through 2026, potentially dropping to 5.5% to 6% by late 2027.

If rates drop to 5.5% by 2027: Buyer demand surges. Anthem prices jump 5% to 7% as affordability improves. Days on market drops to 40 to 50 days. Seller's market returns.

If rates stay above 6.5% through 2027: Demand remains moderate. Anthem prices grow 2% to 3% annually. Days on market stays 60 to 70 days. Balanced market continues.

If rates spike to 7.5%+: Demand freezes. Anthem prices stagnate or decline slightly. Days on market extends to 80 to 100+ days. Buyer's market emerges.

Rates drive everything in mortgage-dependent markets like Anthem.

Economic Factors

Henderson job growth: Tesla Gigafactory expansion, Google Data Center, Raiders practice facility, continued corporate relocations keep Henderson economy strong. This supports housing demand.

Las Vegas tourism: Post-pandemic tourism recovery complete. Formula 1, new entertainment venues, continued convention growth keep Vegas economy healthy. Anthem benefits from proximity without tourist chaos.

California migration: Continues but slowed from pandemic peak. Still brings cash buyers and higher-income residents to Henderson. Supports Anthem pricing.

Recession risk: Low but not zero. If national recession hits in 2026-2027, Anthem prices stall or decline 2% to 5%. Luxury sections (Country Club) get hit harder than value sections (Coventry, Sun City).

By Section: 2026-2027 Outlook

Sun City Anthem: Strongest outlook. Retiree demand stays consistent. 55+ demographic less rate-sensitive. Prices hold or grow 3% to 5% annually. Days on market shortest in Anthem at 45 to 55 days.

Coventry: Entry-level Anthem. Benefits if rates drop and first-time buyers return. Prices grow 2% to 4% annually if economy cooperates. Most competitive section for value-seekers.

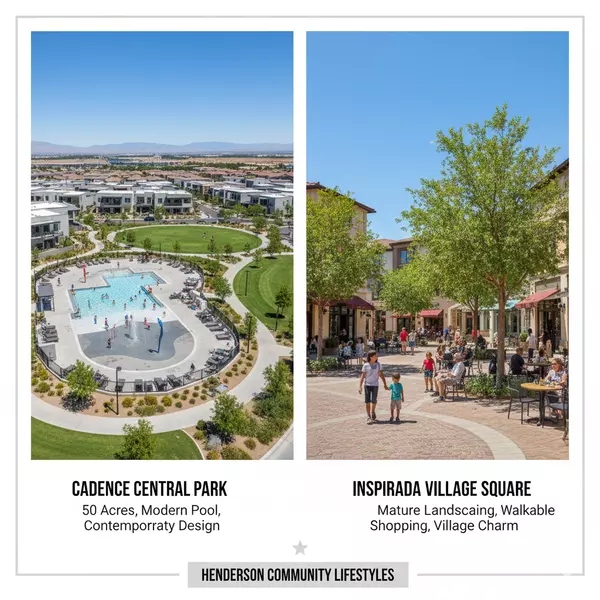

Anthem Highlands: Middle-market grind. Prices stable to modest 2% to 3% growth. Competes with Green Valley Ranch and newer Inspirada/Cadence inventory. Views and elevation differentiate but don't command huge premiums.

Anthem Country Club: Luxury slowdown continues. Prices flat to 1% to 2% growth through 2026. High-net-worth buyers take their time. Expect 90 to 120 days on market. Only best-condition homes at realistic prices sell.

Buy, Sell, or Wait?

If you're buying: 2026 is decent timing. Inventory improving, prices stabilized, negotiation possible. Don't expect steals, but you won't get gouged like 2021-2022. Buy if you find the right home and plan to stay 5+ years.

If you're selling: List now or early 2026. Inventory will increase through 2026-2027, giving buyers more options. Price realistically. Accept that 2021-2022 peak pricing is gone. Don't wait for market to "come back" to old prices.

If you're waiting for crash: Stop. Anthem won't crash. Stable demand (retirees, families, California relocators), limited land supply in Henderson, strong local economy all support prices. You'll wait years for 20%+ price drops that likely won't come.

If you're waiting for rates to drop: You and everyone else. If rates drop significantly, demand surges and prices jump. You save on interest but pay more for the home. Time the life event, not the market.

The Bottom Line

Anthem Henderson 2026-2027 forecast: modest 2% to 4% annual appreciation, gradual inventory increase (10% to 20% more listings), 60 to 75 days on market average, balanced market favoring neither buyers nor sellers heavily.

Sun City Anthem performs best (retiree demand). Country Club slowest (luxury lag). Coventry and Highlands track middle at 2% to 3% annual growth.

No crash coming. No boom either. Just stable, predictable, modest appreciation with more inventory and negotiation opportunities.

Timing the Anthem market for 2026-2027? Want to know if now is the right time to buy or sell? Let's talk. I can show you what's actually happening in real-time and help you make the right move.

Anthem Henderson Real Estate Forecast 2026-2027: Frequently Asked Questions

Categories

- All Blogs (600)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (13)

- Cadence (10)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (54)

- Housing Market Trends (94)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (17)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (164)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION