What Are SID and LID Fees in Las Vegas Real Estate?

Related Articles

- Vegas Builder Incentives: Secret Deals on New Construction

- Las Vegas Condo Prices and Trends: Market Update

- Is Las Vegas Still Affordable in 2025?

If you are buying in a newer Las Vegas community, you will likely encounter SID and LID fees. These are the number one surprise cost for buyers in master-planned communities, and they can add hundreds of dollars to your annual housing expenses. Understanding what they are and how they work helps you budget accurately and avoid surprises.

SID and LID Explained

SID stands for Special Improvement District. LID stands for Limited Improvement District. Both are fees assessed on properties to pay for public infrastructure like roads, sewer lines, parks, street lighting, and other community improvements.

Instead of the city or county paying for this infrastructure, developers create these districts and pass the costs to homeowners. When you buy in a community with active SID/LID, you are essentially paying off bonds that funded the original development.

| Fee Type | What It Funds |

|---|---|

| SID (Special Improvement District) | Roads, sewer, water, parks, public improvements |

| LID (Limited Improvement District) | More localized improvements within specific areas |

How Much Do They Cost?

In master-planned communities like Summerlin, Skye Canyon, Inspirada, and Cadence, SID/LID fees typically range from $300 to $900 semi-annually. That means $600 to $1,800 per year in addition to your:

- Mortgage payment

- Property taxes

- HOA dues

- Homeowner's insurance

These fees usually last 10-20 years or until the bond is fully paid off. The exact amount and duration depend on when the community was developed and how the bonds were structured.

Where SID/LID Fees Are Common

You will typically find SID/LID fees in:

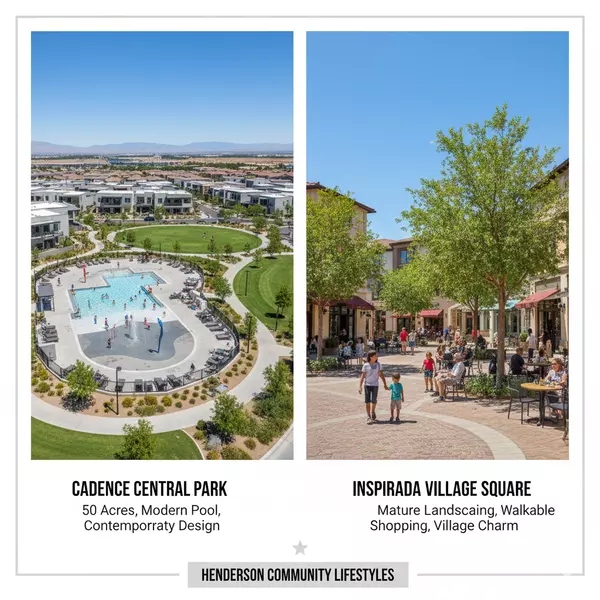

Newer master-planned communities. Summerlin (especially newer villages), Skye Canyon, Inspirada, Cadence, and similar developments.

New construction areas. Most new home communities have active SID/LID because the infrastructure is recently built.

Growing areas. North Las Vegas, southwest Henderson, and other rapidly developing zones.

Older Communities May Be Paid Off

Here is the good news for resale buyers: in older communities or older sections of master-planned communities, SID/LID bonds may already be paid off. This is a significant advantage of buying in established neighborhoods.

When considering a resale home, always ask whether SID/LID fees exist and whether they have been paid off. A home where these fees are resolved saves you thousands over your ownership period compared to a similar home where they are still active.

How to Find Out About SID/LID

SID/LID information should be disclosed during the purchase process, but you can also:

Ask your agent. A knowledgeable local agent can research SID/LID status for any property.

Check the seller's disclosure. Sellers should disclose these fees.

Review the HOA documents. Community documents often reference these fees.

Contact the county assessor. Clark County records show special assessments on properties.

SID/LID vs. HOA Fees

Do not confuse SID/LID with HOA fees. They are separate:

HOA fees: Fund community amenities, maintenance, and management. Ongoing indefinitely.

SID/LID fees: Pay off infrastructure bonds. End when bonds are paid.

In newer communities, you often pay both. Your total monthly housing cost should account for mortgage, taxes, insurance, HOA, and SID/LID.

Impact on Affordability

When comparing homes, factor SID/LID into your calculations. A home that appears $20,000 cheaper may actually cost more monthly if it has $1,500 annual SID/LID fees compared to a slightly more expensive home in an area where fees are paid off.

For Sellers

If you are selling a home where SID/LID has been paid off, this is a selling point worth highlighting. Buyers in established communities with resolved fees have lower ongoing costs than buyers in new developments.

Where to Start

If you are buying or selling in Las Vegas and want to understand how SID/LID affects a specific property, I can help you research these fees and factor them into your decision.

Ready to get the full picture? Request a free home evaluation here or reach out directly to discuss your options.

Frequently Asked Questions About SID and LID Fees in Las Vegas

Categories

- All Blogs (600)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (13)

- Cadence (10)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (54)

- Housing Market Trends (94)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (17)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (164)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION