Selling Your Las Vegas Home with Solar Panels

Related Articles

- Vegas Builder Incentives: Secret Deals on New Construction

- Summerlin Las Vegas: Complete Neighborhood Guide

- Is Las Vegas Still Affordable in 2025?

Solar panels are increasingly common on Las Vegas rooftops. The desert sun makes solar particularly effective here, and many homeowners have invested in systems. But when it comes time to sell, solar panels create considerations that affect your sale. Whether your panels are owned or leased makes all the difference.

Owned vs. Leased: The Critical Distinction

How you acquired your solar panels dramatically affects your sale:

| Ownership Type | Impact on Sale |

|---|---|

| Owned outright | Panels convey with property, adds value |

| Financed (loan) | Loan must be paid off or assumed by buyer |

| Leased | Buyer must qualify and assume lease |

| PPA (Power Purchase Agreement) | Buyer must assume agreement |

If You Own Your Panels Outright

Owned solar panels are the simplest situation and can add value to your home:

They convey with the property. Like other fixtures, owned panels transfer to the buyer.

They represent savings. Buyers understand they will have lower electric bills.

They may add value. Studies suggest solar can add 3-4% to home value, though this varies by market and system.

Documentation helps. Provide system details, production history, and any remaining warranties.

If You Have a Solar Loan

Many homeowners financed their solar systems with loans. At sale:

Pay off the loan. The most straightforward option. Use proceeds from the sale to satisfy the loan, and the panels convey free and clear.

Buyer assumes the loan. Some solar loans are assumable, allowing the buyer to take over payments. This requires lender approval and buyer qualification.

Most sellers pay off solar loans at closing from proceeds, treating it like any other lien on the property.

If Your Panels Are Leased

Leased solar panels complicate sales significantly:

The lease is a contract obligation. Someone must continue making lease payments for the remaining term.

Buyers must qualify. The leasing company must approve the buyer to assume the lease, based on credit and other factors.

Some buyers will not want the lease. A leased system narrows your buyer pool. Some buyers specifically avoid homes with solar leases.

Buyout option. You may be able to buy out the lease and own the panels, which simplifies the sale. Review your lease for buyout terms.

Common Leased Solar Problems

Sellers with leased panels frequently encounter:

Buyer rejection. Some buyers walk away rather than assume a lease obligation.

Financing issues. Some mortgage programs have restrictions on homes with solar leases.

Delayed closings. Lease transfer approval takes time and can slow your transaction.

Buyout costs. If you decide to buy out the lease to facilitate the sale, costs can be significant.

Marketing Solar to Buyers

When marketing a home with solar:

Highlight energy savings. Show actual utility bills demonstrating the savings.

Provide system details. Size, age, production capacity, and warranty information.

Be upfront about ownership. Disclose whether panels are owned, financed, or leased from the start.

Have documentation ready. Lease documents, loan payoff amounts, or ownership proof should be available.

Las Vegas Solar Advantages

Solar makes particular sense in Las Vegas:

Abundant sunshine. Over 300 sunny days per year means excellent production.

High cooling costs. Air conditioning drives significant electric bills that solar can offset.

Net metering. Excess production can credit against future bills.

These advantages make solar attractive to many Las Vegas buyers, but the ownership structure still matters most.

Preparing for Sale

Before listing a home with solar:

Determine ownership status. Confirm whether you own, are financing, or are leasing.

Get payoff or buyout amounts. Know the numbers so you can plan.

Gather documentation. System specs, warranties, production data, and contracts.

Consider your options. Decide whether to pay off financing, buy out a lease, or market with the existing arrangement.

Where to Start

If you are selling a Las Vegas home with solar panels, understanding your ownership situation and its impact on the sale is essential. I can help you navigate solar considerations and market your home effectively.

Ready to discuss your property? Request a free home evaluation here or reach out directly to talk through your situation.

Frequently Asked Questions About Selling Las Vegas Homes with Solar Panels

Categories

- All Blogs (600)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (13)

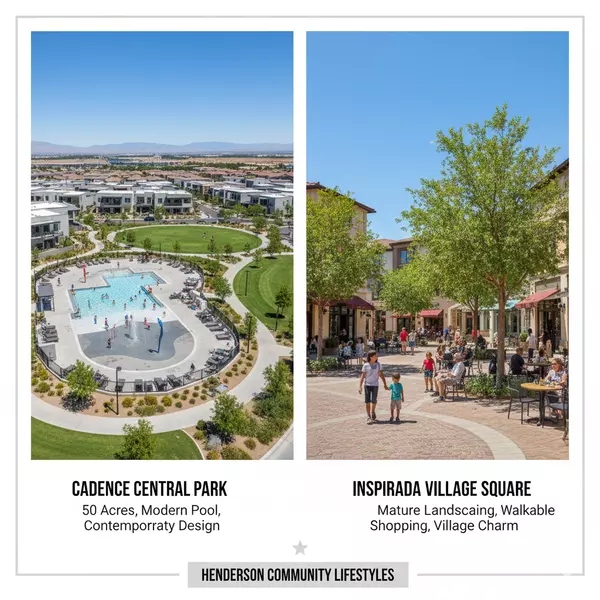

- Cadence (10)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (54)

- Housing Market Trends (94)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (17)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (164)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION