Is Calico Ridge a Good Investment? Real Estate Value Analysis

Whether you're buying to live or looking at investment potential, Calico Ridge has specific characteristics that affect long-term value. Here's an honest analysis.

Historical Appreciation

Calico Ridge has appreciated steadily without the dramatic swings some Henderson communities experienced. Custom homes on larger lots in established communities tend to hold value better during downturns and appreciate consistently during growth periods.

| Investment Factor | Calico Ridge Assessment |

|---|---|

| Price Stability | Strong. Custom homes resist sharp corrections. |

| Appreciation Rate | Moderate. 1-5% annually, steady not explosive. |

| Rental Potential | Limited. Owner-occupied community, fewer renters. |

| Resale Demand | Solid. Low HOA appeals to future buyers. |

What Protects Value Here

Limited supply. Only 400 to 650 homes exist. You can't overbuild Calico Ridge. Scarcity supports pricing.

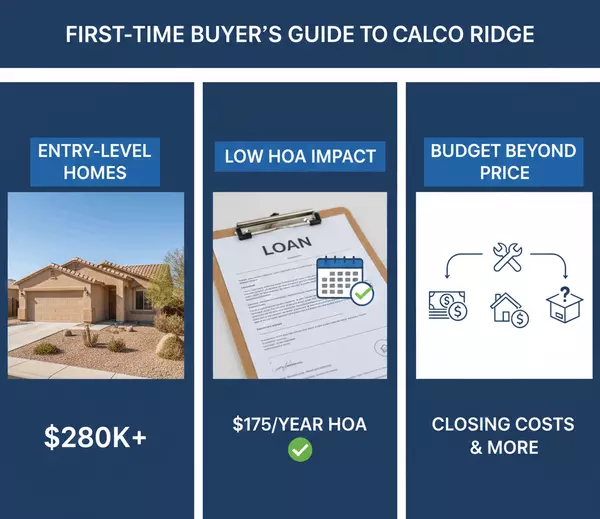

Low HOA structure. Future buyers will compare monthly costs. Calico Ridge's $175 annual fee makes competing communities look expensive. That's a selling advantage you'll have for years.

Lot sizes. Land is finite. Quarter to third-acre parcels become more valuable as Henderson densifies. You can't create more large lots.

Outdoor access. The Wetlands Park and trail system aren't going anywhere. Proximity to natural amenities holds value.

What Could Affect Value

Age of homes. Properties from the late 1990s and early 2000s will need ongoing updates to compete with newer inventory. Deferred maintenance hurts resale.

School ratings. If secondary school ratings decline further, families might choose other communities. School quality affects buyer pools.

Development patterns. Henderson continues growing. How surrounding areas develop could help or hurt Calico Ridge's appeal over time.

Primary Residence vs. Investment Property

| Use Case | Verdict |

|---|---|

| Primary Residence | Strong choice. Live well, build equity steadily. |

| Long-Term Rental | Possible but not ideal. Owner-occupied community vibe. |

| Short-Term Rental | Check HOA rules. Not the target market for STRs. |

| Flip Potential | Moderate. Older homes offer update opportunities. |

Calico Ridge works best as a primary residence where you build equity while enjoying the lifestyle. Pure investment plays might find better cash flow elsewhere.

The HOA Cost Advantage Over Time

Let's quantify this. Calico Ridge's $175 annual HOA versus a typical $200/month Henderson community:

Year 1 savings: $2,225. Year 5 savings: $11,125. Year 10 savings: $22,250.

That's real money staying in your pocket or going toward property improvements that increase value. It compounds as a competitive advantage when you sell.

The Bottom Line

Is Calico Ridge a good investment? For primary residence buyers wanting steady appreciation, low carrying costs, and lifestyle quality, yes. It's not a get-rich-quick flip market, but it's a solid store of value in an established Henderson location.

For pure rental investment, other Henderson areas might offer better returns. Calico Ridge attracts owner-occupants, not tenant populations.

Want to discuss specific properties and their investment potential? Let's talk numbers. Ready to see what's available? Get your current home's value to understand your buying power.

Frequently Asked Questions About Investing in Calico Ridge Henderson

Categories

- All Blogs (713)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (30)

- Assumable Loan (1)

- Buyers (19)

- Cadence (15)

- Calico Ridge (15)

- Centennial Hills (15)

- Comparisons (36)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (4)

- Green Valley (17)

- Henderson (68)

- Housing Market Trends (95)

- Informative (67)

- Inspirada (1)

- Lakes Las Vegas (3)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (18)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (39)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (231)

- Seven Hills (2)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION