Selling Your Las Vegas Home with High HOA Fees

Related Articles

- Summerlin Las Vegas: Complete Neighborhood Guide

- Las Vegas Condo Prices and Trends: Market Update

- Is Las Vegas Still Affordable in 2025?

HOA fees in Las Vegas vary dramatically. Some communities charge $30 per month. Others charge $300 or more. If your home has high HOA fees, this affects buyer perception and ultimately your sale. Understanding how to address HOA concerns helps you market effectively and close at a fair price.

What Counts as High

HOA fee perception is relative to property type and amenities:

| Property Type | Typical Range | High Perception |

|---|---|---|

| Single-family (basic HOA) | $25-75/month | $100+ |

| Master-planned community | $50-150/month | $200+ |

| Guard-gated community | $150-300/month | $400+ |

| Condo/townhome | $150-350/month | $400+ |

| High-rise condo | $400-800/month | $1,000+ |

Why High Fees Concern Buyers

Buyers worry about high HOA fees for several reasons:

Monthly cost impact. HOA fees add to the monthly housing payment. A $300 HOA fee has the same payment impact as roughly $50,000 more in mortgage at current rates.

Future increases. If fees are already high, buyers worry they will go higher.

Value for money. Buyers question whether the amenities justify the cost.

Affordability calculations. Lenders include HOA fees in debt-to-income ratios, potentially limiting how much buyers can borrow.

Justifying the Fees

High HOA fees exist for reasons. Help buyers understand what they get:

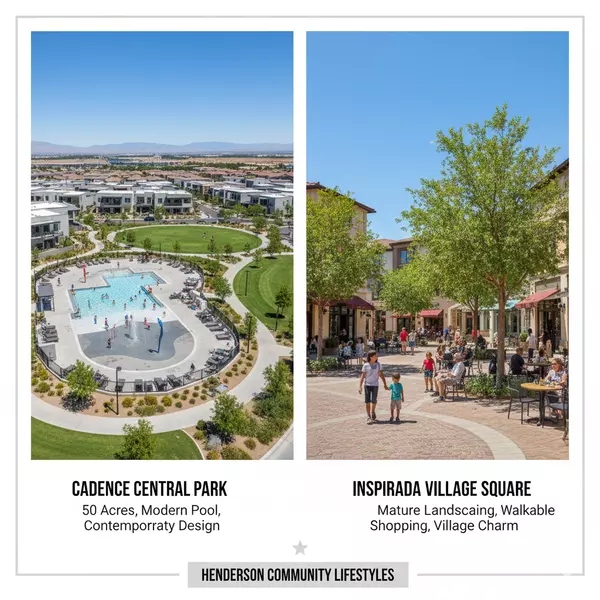

Amenities. Pools, fitness centers, clubhouses, tennis courts, and other facilities have real value.

Guard gates and security. 24/7 staffed gates cost money but provide security and exclusivity.

Exterior maintenance. Some HOAs include roof, exterior paint, or landscaping maintenance.

Utilities. Some fees include water, trash, or other utilities.

Insurance. Condo HOAs typically include building insurance in fees.

Reserves. Well-managed HOAs build reserves for future repairs, preventing special assessments.

Marketing Strategy

When marketing a home with high HOA fees:

Emphasize included value. List everything the HOA fee covers.

Calculate the real cost. If utilities or maintenance are included, show what buyers would pay separately without the HOA.

Highlight amenities. Professional photos of community amenities help justify fees.

Target the right buyers. Some buyers specifically want full-amenity communities and expect higher fees.

Pricing Considerations

High HOA fees typically require pricing adjustments:

Compare to similar fee communities. Your competition is other homes with similar HOA structures, not the broader market.

Understand buyer math. Buyers comparing monthly payments will factor in your higher fees.

Price realistically. Homes with high fees often sell for less per square foot than comparable homes with lower fees.

HOA Financial Health

Buyers will review HOA documents. Be prepared for questions about:

Reserve fund. Is the HOA adequately funded for future expenses?

Recent or planned assessments. Any special assessments on the horizon?

Fee history. How much have fees increased over time?

Pending litigation. Any lawsuits involving the HOA?

A well-managed HOA with strong reserves can actually reassure buyers, even with higher fees.

The Summerlin Factor

Many Summerlin homes have multiple HOA layers, with a master HOA fee plus sub-association fees. This is common in Las Vegas master-planned communities. Buyers familiar with the market understand this structure, but you should clearly disclose total monthly HOA obligations.

When Fees Are a Deal-Breaker

Some buyers simply will not pay high HOA fees regardless of amenities. Accept that your buyer pool is smaller and focus marketing on buyers who value what the community offers.

Where to Start

If you are selling a Las Vegas home with high HOA fees, strategic pricing and marketing can address buyer concerns. I can help you position your property effectively and find buyers who appreciate what your community offers.

Ready to discuss your property? Request a free home evaluation here or reach out directly to talk through your options.

Frequently Asked Questions About Selling Las Vegas Homes with High HOA Fees

Categories

- All Blogs (600)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (13)

- Cadence (10)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (54)

- Housing Market Trends (94)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (17)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (164)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION