Green Valley Ranch Market Forecast 2026-2027: Investment Analysis

Related Articles

Green Valley Ranch forecast 2026: +5-8% appreciation (moderating from +13% 2025). 2027: +3-5% continued strength. Strong fundamentals (walkability, schools, limited supply) support long-term investment case.

Here's your complete market forecast and buy vs wait analysis.

2025 Recap: Record Appreciation

Median price 2025: $595K-$637K (December 2025), up from $550K range January 2025.

Appreciation 2025: +13% year-over-year. Highest among established Henderson communities. Anthem +3-5%, Cadence +2-5%, Inspirada +4.8%.

What drove 2025 gains: Walkability premium (The District unique in Henderson), Vanderburg Elementary 10/10 attracting families, limited inventory (resale-only market, no new construction), central Henderson location (15 min to Strip), post-rate-spike recovery (buyers adjusting to 7% rates).

Days on market 2025: 47-51 days average, up from 31 days in 2024 but still fastest Henderson turnover.

2026 Forecast: Moderation to +5-8% Appreciation

Projected median price end of 2026: $625K-$690K (depending on appreciation rate).

Conservative scenario (+5%): $595K x 1.05 = $625K median by December 2026.

Moderate scenario (+6.5%): $595K x 1.065 = $634K median.

Optimistic scenario (+8%): $595K x 1.08 = $643K median.

Most likely outcome: +6% to +7% appreciation. Median reaches $630K-$637K by end of 2026.

Why moderation from +13%: Double-digit appreciation is unsustainable. Market adjusting to higher rate environment. Inventory increasing slightly (more sellers accepting new pricing reality). Buyer demand strong but not frenzied. 5-8% is healthy appreciation, not bubble territory.

2027 Forecast: Continued Strength at +3-5%

Projected median price end of 2027: $650K-$670K (starting from $630K-$637K end 2026 baseline).

Conservative scenario (+3%): $630K x 1.03 = $649K median.

Moderate scenario (+4%): $635K x 1.04 = $660K median.

Optimistic scenario (+5%): $637K x 1.05 = $669K median.

2027 outlook: Stable, sustainable growth. 3-5% annual appreciation is long-term healthy rate for established communities. Green Valley Ranch benefits from walkability and schools maintaining demand.

Inventory Trends: Slight Increase Expected

Current inventory (Q4 2025): Limited supply. Resale-only market (no new construction). Sellers with low-rate mortgages hesitant to list.

2026 inventory forecast: 10-20% increase in listings as "lock-in effect" weakens. Sellers accepting 7% rates as new normal. More inventory doesn't crash market - just normalizes it from ultra-tight conditions.

2027 inventory forecast: Continued gradual increase. Still below pre-COVID levels but healthier balance. 3-4 months supply (balanced market) vs current 2 months (seller's market).

Impact on buyers: More homes to choose from. Less competition per listing. Negotiations slightly favor buyers (5-7% below list vs current 2-3% below list).

Impact on appreciation: Inventory increase slows appreciation to 3-5% range but doesn't reverse it. Green Valley Ranch fundamentals (walkability, schools) support continued growth.

Days on Market: Stabilizing at 50-60 Days

Current: 47-51 days average.

2026 forecast: 50-60 days average. Slight increase as inventory grows and buyers have more options.

2027 forecast: 55-65 days average. Normalizing to pre-COVID pace.

What this means: Homes still sell in reasonable timeframe. Not sitting 90-120+ days like some Henderson communities. Green Valley Ranch walkability and schools keep demand strong.

Investment Analysis: Strong Fundamentals

Walkability premium persists: The District walkability is permanent advantage. No other Henderson community can replicate this. Walkability premium holds even in slower markets.

Vanderburg Elementary 10/10: School quality doesn't decline with market cycles. Families pay premium for top schools regardless of broader market conditions.

Limited supply: No new construction in Green Valley Ranch. Community is built out. Supply limited to resales. This caps inventory even as more sellers list.

Central location: 15 minutes to Strip, airport, downtown Henderson. Geographic advantage persists. Remote work normalization makes central location more valuable (easy access to everything).

Established community: 30+ years mature landscaping, stable HOAs, proven track record. Less risk than new construction communities with unknown long-term viability.

Buy Now vs Wait: Decision Framework

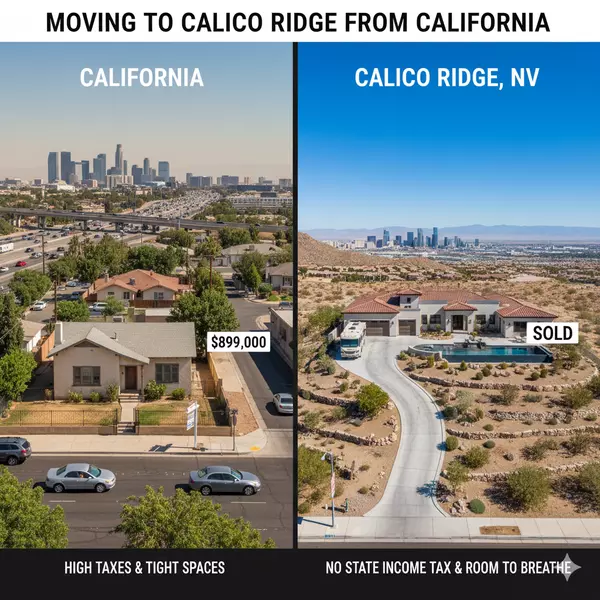

Buy now if: You plan 5+ year hold (appreciate through 2026-2027 growth), You found right home in right neighborhood (Vanderburg boundary, District walkability), Current rent equals or exceeds $2,800 monthly (ownership builds equity), You're financially stable (job security, 6+ month emergency fund), Nevada $0 state income tax benefits your situation (moving from California saves 5-13% annually).

Wait if: You need to sell within 2-3 years (market timing risk), You're uncertain about Henderson long-term (might relocate), Your budget is maxed out (no cushion for maintenance, HOA increases), You're hoping for price drops (unlikely given strong fundamentals), Rates might drop to 5% (don't time the market - rates unpredictable).

The math on waiting: If you wait 12 months hoping for better prices: Median rises from $595K to $632K (+6% appreciation) = $37K increase. You paid $37K in rent ($3,100 x 12 months) = $37K cost. Net: Break even at best, likely lost $40K-$70K in combined appreciation and rent paid.

Rate timing fallacy: Waiting for 5% rates means: More buyer competition when rates drop. Prices rise 10-20% when rates drop 2%. You pay $100K more in purchase price to save $200 monthly payment. Better to buy now at $595K with 7% rate, refinance later if rates drop.

Risk Factors to Monitor

Interest rate environment: If rates rise to 8-9%, buyer pool shrinks. Unlikely but possible. If rates drop to 5-6%, prices surge (bad for buyers, good for owners).

Inventory surge: If lock-in effect breaks suddenly (mass refinancing program, rate drop), inventory could spike 30-50%. Would slow appreciation to 0-2% but unlikely to crash prices given fundamentals.

Economic recession: Job losses reduce buyer pool. Henderson less vulnerable than tourist-heavy Strip economy. Healthcare, professional services, government jobs more stable.

HOA financial health: Special assessments can hit if HOA reserves depleted. Review reserve studies for your target neighborhood. Well-funded reserves (40%+ ratio) reduce risk.

Comparative Forecast: GVR vs Other Henderson Communities

| Community | 2026 Forecast | 2027 Forecast |

|---|---|---|

| Green Valley Ranch | +5-8% | +3-5% |

| Anthem | +3-5% | +2-4% |

| Cadence | +3-6% | +3-5% |

| Inspirada | +4-6% | +3-5% |

Green Valley Ranch continues outperforming on appreciation due to walkability and schools. Gap narrows but GVR maintains lead.

The Bottom Line

Green Valley Ranch forecast 2026: +5-8% appreciation ($625K-$643K median), 50-60 days on market, 10-20% inventory increase. 2027 forecast: +3-5% appreciation ($650K-$670K median), continued strength.

Strong fundamentals support investment: The District walkability (no Henderson competitor), Vanderburg 10/10 school (family magnet), limited supply (resale-only, no new construction), central location (15 min Strip/airport).

Buy now if 5+ year hold, right home found, financially stable. Wait risks paying $37K-$70K more in combined appreciation and rent within 12 months.

Rate timing fallacy: Waiting for 5% rates means 10-20% price surge erases monthly payment savings. Buy now, refinance later if rates drop.

Green Valley Ranch outperforms Henderson appreciation through 2027 due to unique walkability and school advantages. Fundamentals persist through market cycles.

Ready to invest in Green Valley Ranch before 2026 appreciation? Need investment analysis for specific neighborhoods? Let's talk. I can project returns and guide your GVR investment strategy.

Green Valley Ranch Market Forecast 2026-2027: Frequently Asked Questions

Categories

- All Blogs (703)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (29)

- Assumable Loan (1)

- Buyers (18)

- Cadence (15)

- Calico Ridge (10)

- Centennial Hills (15)

- Comparisons (35)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (3)

- Green Valley (17)

- Henderson (66)

- Housing Market Trends (95)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (3)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (18)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (39)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (228)

- Seven Hills (2)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION