Should You Sell Your Las Vegas Home or Refinance?

Related Articles

- Las Vegas Condo Prices and Trends: Market Update

- Vegas Builder Incentives: Secret Deals on New Construction

- Is Las Vegas Still Affordable in 2025?

You need cash, or your current mortgage situation is not working. You are weighing two options: sell the home and access all your equity, or refinance and tap some equity while keeping the property. This is a significant financial decision with long-term implications. Here is how to think through your options.

Understanding Your Options

Selling means converting your entire equity position to cash, minus selling costs. You walk away with a lump sum but give up ownership and must find somewhere else to live.

Refinancing means replacing your current mortgage with a new one, potentially with different terms or a higher balance that gives you cash out. You keep the home but take on new debt.

| Consideration | Selling | Refinancing |

|---|---|---|

| Access to equity | Full equity minus costs | Partial (typically up to 80% LTV) |

| Ongoing costs | None (no mortgage) | New mortgage payment |

| Transaction costs | 8-10% of sale price | 2-5% of loan amount |

| Keep the home | No | Yes |

| Credit impact | Minimal | Credit pull, new account |

When Selling Makes More Sense

Selling may be the better choice when:

The home no longer fits your needs. If you need to move anyway, whether for space, location, lifestyle, or other reasons, accessing equity through a sale accomplishes two goals at once.

You need maximum cash. Selling accesses your full equity. Refinancing only lets you borrow a portion.

Your current rate is low and you do not want to lose it. If you have a 3% mortgage from 2021, refinancing at today's higher rates could significantly increase your payment. Selling avoids this problem entirely.

You want to eliminate housing costs. If you can move to a paid-off situation, help family housing, or significantly downsize, selling eliminates your mortgage payment entirely.

When Refinancing Makes More Sense

Refinancing may be better when:

You want to stay in the home. If you love your home and your situation, refinancing lets you access equity without leaving.

Your cash need is modest. If you need $50,000, selling a $500,000 home to get it is overkill. A cash-out refinance is more proportionate.

Current rates are favorable. If you can improve your rate or your current rate is not dramatically lower than market rates, refinancing costs are easier to justify.

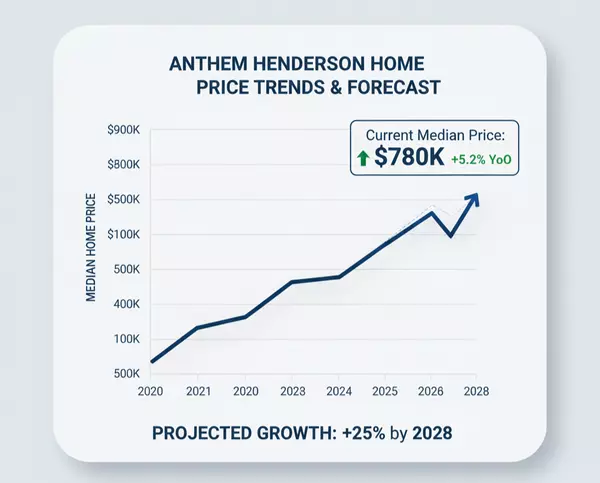

You expect appreciation. If you believe your home will continue appreciating, keeping it lets you benefit from future gains.

The Rate Lock Problem

Many Las Vegas homeowners locked in historically low rates during 2020-2022. These sellers face a dilemma: they have a mortgage at 3% or less, but refinancing means giving that up for rates of 6-7% or higher.

If your current rate is exceptionally low, refinancing becomes much less attractive. The math changes dramatically when your new payment could be 40-60% higher even without increasing your balance.

For these homeowners, the choices are often: stay put and keep the low rate, sell and accept that any new purchase will be at higher rates, or find alternative sources for needed cash.

Other Alternatives

If neither selling nor traditional refinancing is ideal:

Home equity line of credit (HELOC). Access equity as a revolving line without replacing your first mortgage. You keep your low rate and pay interest only on what you draw.

Second mortgage. Borrow against equity without touching your first mortgage. Higher rate than the first but preserves your existing low-rate loan.

Sell and rent. If you need cash but local buying does not make sense, selling and renting can be a transitional strategy.

Running the Numbers

Any decision this significant deserves careful calculation:

If selling: What would you net after all costs? What are your housing alternatives and their costs? How does your total financial picture change?

If refinancing: What would your new payment be? How does total cost over the loan term compare? What do closing costs add to the effective cost of accessing this equity?

Where to Start

If you are weighing selling versus refinancing your Las Vegas home, I can help you understand what you would net from a sale so you can compare it fairly to refinancing options. Having accurate numbers makes the decision clearer.

Ready to explore your options? Request a free home evaluation here or reach out directly to discuss your situation.

Las Vegas Home Refinance vs Selling: Frequently Asked Questions

Categories

- All Blogs (580)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (12)

- Centennial Hills (15)

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (44)

- Housing Market Trends (94)

- Informative (65)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (15)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (154)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION