Why Didn't My Las Vegas Home Appraise for What I Paid?

Related Articles

- What Happens If the Appraisal Comes in Low

- Why Your Zestimate Is Wrong

- How Much Equity Do I Need to Sell?

You bought your house two years ago for $475,000. Now you're selling and the appraisal came back at $460,000. Wait, what? How is your home worth less than you paid?

Deep breath. It happens more than you'd think. Let me explain why.

You Might Have Overpaid

I know. Nobody wants to hear this. But during the 2021-2022 frenzy, buyers paid above market value just to win bidding wars. They waived appraisals. They covered gaps out of pocket. They did whatever it took to get a house.

Appraisers don't care about bidding wars. They look at comparable sales and market data. If you paid $30,000 over asking to beat five other offers, the appraisal was never going to validate that premium.

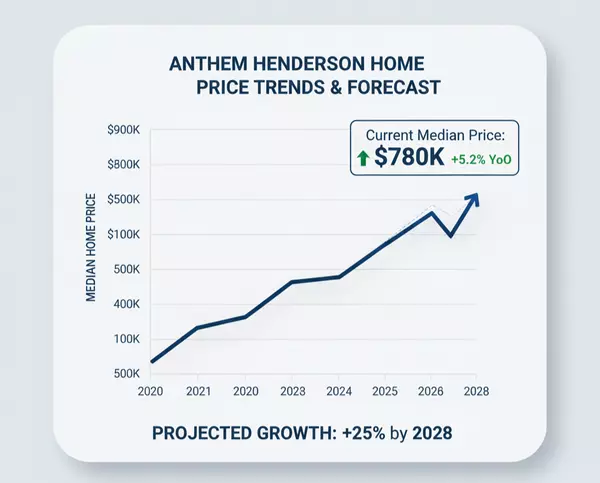

The Market Shifted

Real estate doesn't always go up. Las Vegas prices peaked in mid-2022 and have since stabilized. Some areas dipped slightly before leveling off.

If you bought at the peak and prices have softened even 3-5%, that's $15,000-25,000 on a $500,000 house. Add in the premium you paid to win the bidding war, and suddenly you're underwater on paper.

Appraisers Use Recent Sales

Appraisals are backward-looking. They're based on what similar homes actually sold for in the past 3-6 months. They don't predict the future or factor in what you hope the market does.

If recent sales in your neighborhood have been soft, your appraisal reflects that reality, regardless of what you paid two years ago.

Your Improvements Don't Count Like You Think

You spent $20,000 on a new patio cover. You upgraded all the appliances. You put in custom closets.

Here's the hard truth: most improvements don't return dollar-for-dollar. That $20,000 patio might add $8,000-12,000 of appraised value. Maybe. Appraisers have formulas, and they don't match Home Depot receipts.

Different Appraiser, Different Opinion

Appraisals are opinions. Educated, data-backed opinions, but opinions nonetheless. Two appraisers can look at the same house and come up with different numbers.

If you got a particularly conservative appraiser or one unfamiliar with your specific neighborhood, that can impact results.

What This Means for Selling

If your appraisal came in lower than expected:

Know your actual equity. Run the numbers with realistic expectations, not what you hoped.

Price accordingly. If comparable homes are selling for $460,000, that's your market. Pricing at $490,000 because "that's what I paid" doesn't work.

Consider timing. If you don't need to sell right now, waiting for appreciation might make sense. Or it might not. Nobody has a crystal ball.

The Good News

Low appraisals sting, but they're just numbers on paper. If you're not selling, it doesn't matter. You still have a roof over your head. You're still building equity with every payment.

And if you are selling, at least you know the truth. Better to price right and sell than to chase a fantasy number and sit on the market for months.

Trying to figure out what your Las Vegas home is actually worth today? Get a free evaluation based on current market data, not wishful thinking.

Las Vegas Home Appraisal Questions: Common Concerns When Your Home Value Differs from Purchase Price

Categories

- All Blogs (580)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (19)

- Assumable Loan (1)

- Buyers (12)

- Centennial Hills (15)

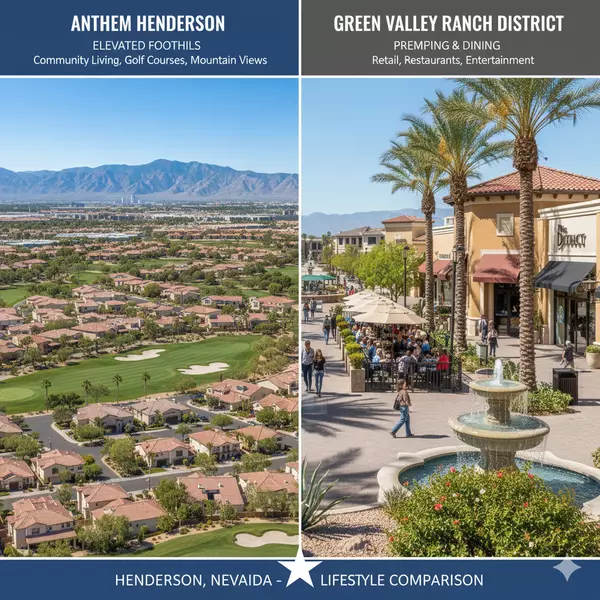

- Comparisons (30)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (2)

- Green Valley (2)

- Henderson (44)

- Housing Market Trends (94)

- Informative (65)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (15)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (35)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (154)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION