What Sellers Should Know About First-Time Buyers in Las Vegas

Related Articles

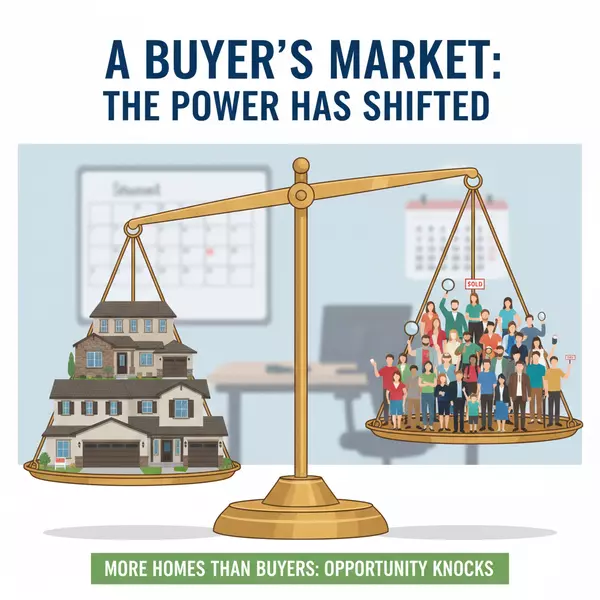

With investor purchases down 20% and cash buyers at 23% of transactions, a large portion of your potential buyers are first-timers. They're excited, nervous, and often need more hand-holding than experienced buyers.

Here's what selling to them looks like.

They Often Use FHA or Low Down Payment Loans

First-time buyers typically don't have 20% to put down. Many use FHA loans (3.5% down) or conventional loans with 3-5% down.

What this means for you:

Stricter appraisals. FHA appraisals have condition requirements. Peeling paint, broken windows, safety issues must be addressed.

Longer closing times. Low down payment loans often take 35-45 days to close, sometimes longer.

More scrutiny. Lenders are careful with first-time buyers. Deals can hit snags during underwriting.

They're Cash-Strapped

First-time buyers are often stretching to afford the down payment. They may have little left for closing costs, moving expenses, or immediate repairs.

Expect concession requests. Asking for 2-3% toward closing costs is common. It helps them get into the home without draining their savings completely.

Consider it part of the deal. A $10,000 concession on a $400,000 home might be what makes the sale happen.

They're Emotional

For first-time buyers, this isn't just a transaction. It's a dream coming true. They're imagining holidays, kids, pets, their whole future in your home.

That emotion cuts both ways:

They may fall in love quickly. An emotional connection can lead to strong offers and motivation to close.

They may get cold feet. Big decisions trigger anxiety. Some first-timers panic mid-escrow.

Inspection reactions can be dramatic. Every minor issue feels major to someone who's never owned a home before.

Inspections Can Be Challenging

First-time buyers don't know what's normal. When the inspection report lists 30 items, they might think the house is falling apart. Experienced buyers know that every inspection finds issues.

Expect repair requests that include minor items. Some requests will seem excessive. Their agent should help them understand what's reasonable, but be prepared to educate through negotiation.

They Need More Time and Communication

First-time buyers have questions. Lots of questions. They're learning the process while living it.

Your agent will field many of these, but smooth transactions require patience. Quick responses, clear communication, and flexibility help deals close.

The Upside of First-Time Buyers

Despite the challenges, first-time buyers offer real advantages:

No sale contingency. They're not waiting to sell another home. The deal depends only on their financing.

Motivated to close. They want this to work. They're not casually shopping.

Flexible on timing. Without another sale to coordinate, they can often work around your preferred timeline.

They're a big part of the market. With investors retreating and cash buyers limited, first-timers are a significant buyer pool. Dismissing them shrinks your options.

Making It Work

Price for their budget. First-timers are rate-sensitive and payment-focused. Price competitively to attract them.

Consider FHA condition. If your home has obvious issues that will fail FHA appraisal, address them before listing or price accordingly.

Be patient with the process. First-time buyer deals take longer. Plan for 45+ days.

Offer concessions strategically. Helping with closing costs can seal a deal.

The Bottom Line

First-time buyers require more patience but represent a crucial part of today's Las Vegas market. Understanding their challenges and needs helps you successfully navigate deals with them.

Questions about selling to first-time buyers in Las Vegas? Let's discuss how to position your home for this buyer pool.

Common Questions About Selling to First-Time Homebuyers in Las Vegas

Categories

- All Blogs (616)

- Absentee Owner (4)

- Affordability (3)

- Aliante (2)

- Anthem (20)

- Assumable Loan (1)

- Buyers (16)

- Cadence (15)

- Centennial Hills (15)

- Comparisons (31)

- Desert Shores (2)

- Divorce (2)

- Downsizing (13)

- Empty Nester (1)

- Enterprise (1)

- Expired Listings (2)

- First Time Homebuyer (3)

- Green Valley (2)

- Henderson (58)

- Housing Market Trends (95)

- Informative (65)

- Inspirada (1)

- Lakes Las Vegas (2)

- Luxury (1)

- MacDonald Highlands (2)

- Madeira Canyon (1)

- Mountains Edge (17)

- New Construction (18)

- North Las Vegas (23)

- Probate (28)

- Providence (1)

- Queensridge (1)

- Relocation (36)

- Retired (1)

- Retirement (1)

- Rhodes Ranch (2)

- Sellers (174)

- Seven Hills (1)

- Silverado Ranch (1)

- Skye Canyon (3)

- Southern Highlands (8)

- Southwest (17)

- Spring Valley (10)

- Summerlin (47)

- Sun City Summerlin (3)

- Thoughts on Home Tour (2)

- Veterans (2)

Recent Posts

GET MORE INFORMATION